As an on-demand driver you already know that you are responsible for your own taxes. This is because you are classified as a contractor. It’s like running your own business. You are the boss. But also you have tax obligations. It may seem daunting but the upside of this is that you can take advantage of a number of tax deductions to maximize your returns. This means more money in your pocket, not uncle Sams.

You probably already know that you can claim many of your bills when driving for Uber. But did you know you can use Veryfi to:

(a) collect your receipts, stay organized and always be on time and prepared for tax time and

(b) automatically track the miles you drove which are also favorable tax deductible.

How to maximize your tax returns

(a) Don’t loose those receipts! You will need them when it comes to tax time. Your accountant will use those as a way to maximize your deductions and offset your income tax.

(b) Track your mileage. An average Uber driver drives 30,000 miles per year. That’s a deduction roughly $15,000 against your taxable income.

| Gas / Fuel | Schedule C (Form 1040) Line 9 |

| Maintenance | Schedule C (Form 1040) Line 9 |

| Mobile Phone and Charger(s) | Schedule C (Form 1040) Line 22 |

| Food and Drinks for Passengers | Schedule C (Form 1040) Line 24b |

| Car Washes | Schedule C (Form 1040) Line 9 |

| Parking fees | Schedule C (Form 1040) Line 9 |

| Tolls | Schedule C (Form 1040) Line 9 |

The right tools for the job

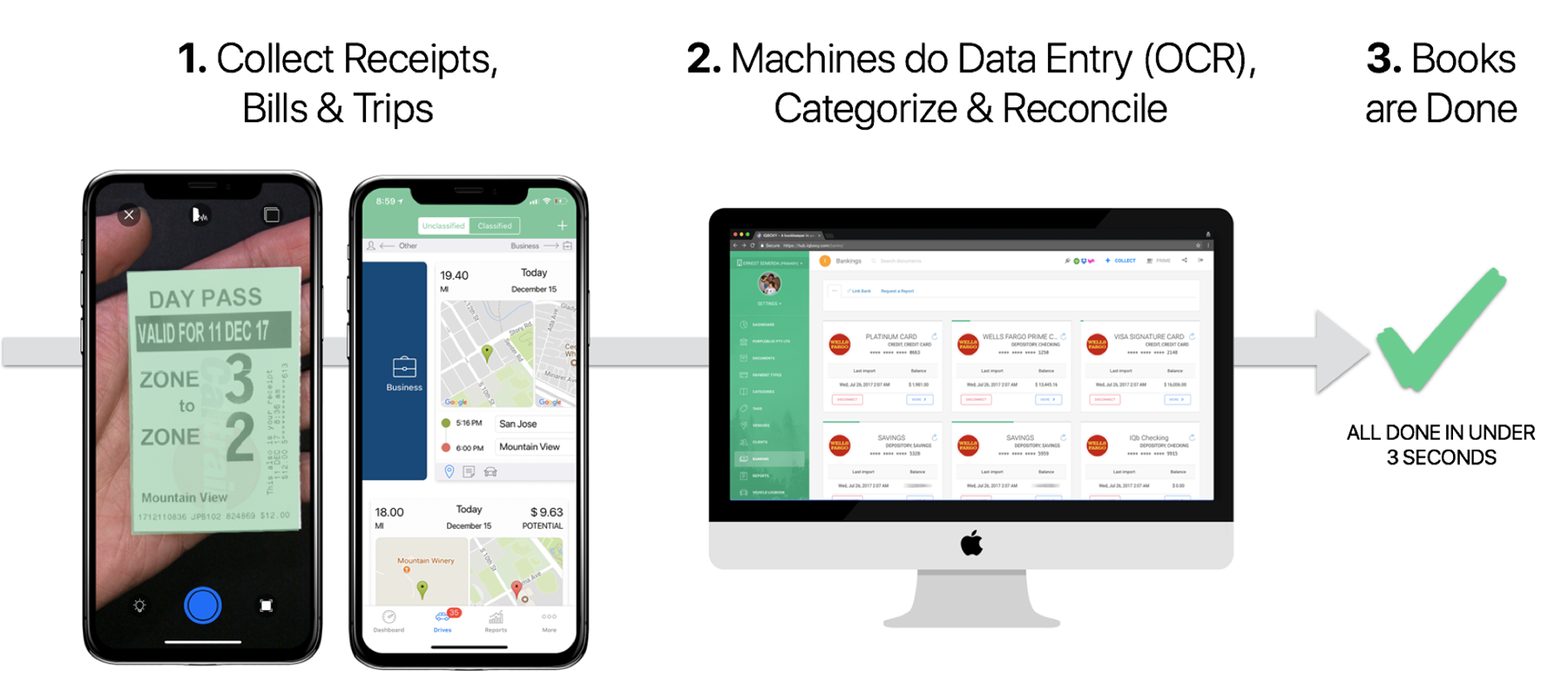

Veryfi is a family of bookkeeping apps that remove the burden of manual data entry and automate the process of collection, categorization & reconciliation.

| Keep tax deductible receipts (photos, email et al) in a safe place for tax time | Veryfi Receipts | $8,300 |

| Track your vehicle’s business mileage for tax | Veryfi Logbook | $8,800 |

How Veryfi works

Veryfi app identifies the document in real-time, crops it and extract all the document data it can see. Reducing the burden of manual labor data entry. And when you invite your CPA / Accountant to access your receipts, then your tax prep is also done since they get access to your tax deductibles in real-time. Easy right.

Have questions? We’re always here to help.

Don’t hesitate to get in touch with us directly by clicking the button below. Ask us anything.