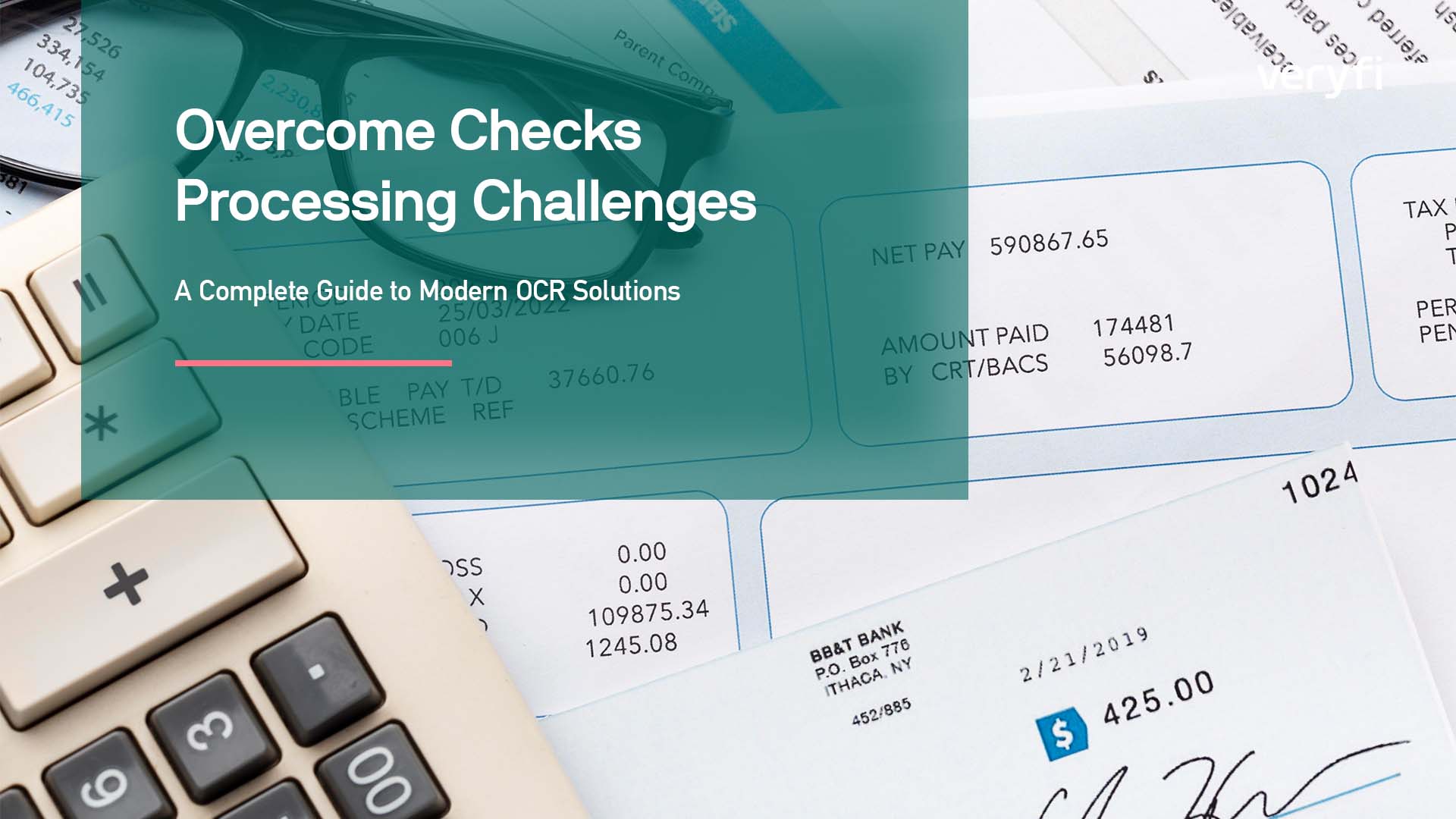

Financial institutions face increasingly complex check processing challenges in today’s digital banking environment. Before the era of digital banking and OCR technology, check processing was an intricate maze of manual operations and complex routing systems. The process was mainly with workers physically sorting checks and using mechanical adding machines for “listing” (adding up check values). Can you believe this is how Bank of America or J.P. Morgan used to process checks? Before modern automation, all banks faced similar technological limitations: manual sorting, mechanical adding machines for listing check values, and physical transportation of checks between locations.

Despite the rise of digital payments, check processing remains a critical operation for many financial institutions and businesses. In 2024, organizations still face complex challenges with check processing, particularly when handling multiple checks simultaneously. This comprehensive guide explores modern solutions to these challenges and their impact on operational efficiency.

Key Check Processing Challenges Today

Today’s financial institutions face several unique obstacles in check processing:

- Multiple Checks per Page

- Batch submissions with varying layouts

- Different check sizes and orientations

- Mixed personal and business checks

- Overlapping or crowded arrangements

- Image Quality Variations

- Inconsistent scan resolutions

- Shadow and glare effects

- Color variations and contrast issues

- Background noise and artifacts

- Complex Data Capture Requirements

- Handwritten text recognition

- MICR code extraction

- Front and back verification

- Multiple field validation

Advanced OCR Capabilities Transforming Check Processing

AI OCR check processing is the use of advanced artificial intelligence and machine learning algorithms to automatically extract, analyze, and process data from physical or digital check images. These modern solutions have evolved to address these specific challenges through AI-powered features:

1. Intelligent Document Analysis

- Automatic check detection on any background

- Multi-check separation technology

- Front and back matching capabilities

- Background elimination, even with white-on-white checks

2. Enhanced Data Capture

- MICR code recognition and validation

- Handwriting interpretation across different styles

- Automated fields extraction

3. Quality Assurance Features

- Real-time image quality assessment

- Automatic resolution optimization

- Clarity enhancement

- Validation checks for required fields

ROI Analysis: The Business Case for Automation

Let’s examine the financial impact of implementing modern check processing solutions for 10,000 checks:

| Metric | Manual Processing | Automated Solution | Annual Savings |

| Processing Costs | $20,000-40,000 | $2,000-5,000 | $15,000-35,000 |

| Error Correction | $5,000-10,000 | $500-1,000 | $4,500-9,000 |

| Training | $2,000 | $500 | $1,500 |

| Labor Hours | 2,000 hours | 400 hours | 1,600 hours |

Note: Actual savings may vary based on organization size, current processes, and implementation approach

Implementing Check Processing Solutions

Modern check processing challenges require sophisticated solutions. By implementing AI-powered OCR technology, organizations can transform their check processing operations from a bottleneck into a competitive advantage.

Consider starting with a pilot program to:

- Evaluate current processing costs

- Test automated solutions

- Measure improvement metrics

- Calculate actual ROI

The future of check processing is here – the question is no longer whether to automate, but how quickly you can implement these transformative solutions. Looking to modernize your check processing? Start with a free trial to see the impact of automated solutions firsthand. Schedule a personalized demo to see how modern OCR solutions address your specific challenges.