Fraud Detection Fraud Detection

Identify altered bills, manipulated receipts & bills, suspicious activities, duplicate documents and more. Mitigate risks in your loyalty programs and bill payment solutions by proactively flagging potential fraud, eliminating risk and associated costs.

Get Started for Free

Detect Fraud in Real-TimeDetect Fraud in Real-Time

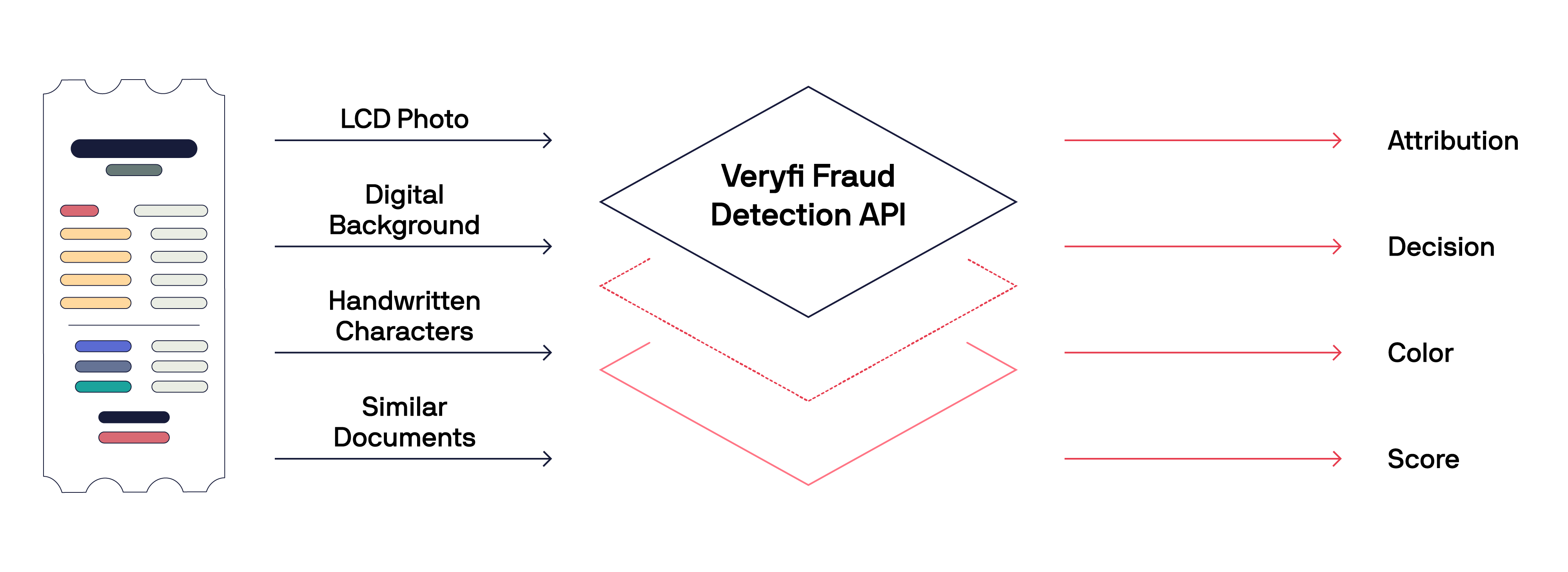

The Fraud Detection Service by Veryfi supplements the core data extraction APIs. Its purpose is to detect potential fraudulent documents submitted for data extraction. Utilizing a wide range of Signals, it scrutinizes each document submission analyzing it for digital manipulation, historical insights and velocity activity and employs Triggers to flag the JSON response. For Example; determining whether to initiate an investigation by a human review team can be as straightforward as implementing the following pseudocode inside Veryfi’s Business Rules Engine for every processed JSON.

Catch GenAI FraudCatch GenAI Fraud

Veryfi’s OCR API can sniff out those digitally concocted receipts faster than you can say “expense reimbursement.” Whether it’s a ChatGPT masterpiece, a Stable Diffusion creation, MidJourney magic, GAN trickery, or a DALL-E special – our AI detective is on it.

Did You Know?Did You Know?

-

Invoice and Billing Fraud

Estimated to cost businesses over $100 billion annually worldwide. It’s believed that 5-10% of all invoices contain errors or fraudulent charges.

-

Check Fraud

Still a major issue despite declining check usage. The American Bankers Association reported $1.3 billion in check fraud losses in 2018.

Let’s not forget the recent viral TikTok Chase Bank money fraud

Let’s not forget the recent viral TikTok Chase Bank money fraud -

Loyalty Program Fraud

Costs companies an estimated $1 billion per year globally. About 1 in 5 loyalty accounts are affected by fraud.

-

Expense Report Fraud

Accounts for 5% of business fraud cases. The median loss is $31,000 per case.

Stop Fraud in Real-TimeStop Fraud in Real-Time

-

AI Generated Document Detective

Veryfi’s OCR API can sniff out those digitally concocted receipts faster than you can say “expense reimbursement.” Whether it’s a ChatGPT masterpiece, a Stable Diffusion creation, MidJourney magic, GAN trickery, or a DALL-E special – our AI detective is on it. Read More

-

Manipulated Handwriting

Veryfi’s Fraud Detection system uses advanced image processing and machine learning to identify manipulated handwriting in real-time. It analyzes stroke consistency, pressure variations, and ink properties through contour analysis and spectral techniques. The system employs Natural Language Processing to detect semantic inconsistencies. By comparing features against genuine samples and known fraud patterns, it can identify various handwriting manipulations, from simple additions to complex forgeries, ensuring real-time document integrity.

-

Manipulated Photos

Veryfi’s Fraud Detection system uses advanced computer vision and machine learning to identify manipulated photos in real-time. For digital alterations, it employs error level analysis, noise detection, and deep learning to spot pixel irregularities and metadata anomalies. Physical manipulations are detected through adaptive thresholding and forensic analysis of handwriting and ink properties. The system cross-references findings against a database of known fraud patterns, enabling robust detection of both subtle and overt manipulations across various document types, countering sophisticated fraud attempts in real-time.

-

Duplicate Document

Fraud Intelligence employs sophisticated algorithms to analyze image similarity and text content, enabling it to identify duplicate submissions of previously processed documents. This system not only detects current instances of fraud but also proactively mitigates future risks associated with each unique fraud case. The technology utilizes a meta.is_duplicate field to flag and track these duplicate entries. This approach ensures a comprehensive defense against both repeated and evolving fraud attempts, enhancing overall security and integrity in document processing.

-

Document Velocity

Veryfi’s Fraud Intelligence incorporates Document Velocity analysis to detect suspicious submission patterns in real-time. This feature monitors the frequency and volume of document submissions from individual devices across various timeframes. By employing statistical modeling and machine learning algorithms, the system identifies abnormal spikes or consistently high submission rates from specific sources. Such elevated velocity is a strong indicator of fraudulent activity, with nearly 100% correlation to fraud attempts. This proactive approach allows for immediate flagging of potentially fraudulent submissions, enabling swift intervention and significantly reducing the risk of large-scale fraud operations.

-

LCD Photo

As printer use declines, a new form of digital manipulation is emerging. Fraudsters are using Photoshop to alter documents, then capturing images of these altered documents displayed on LCD screens. This method involves taking pictures of desktop monitors, tablets, or phone screens. However, there’s no need for concern. Veryfi’s Fraud Detection technology can analyze these photos to determine whether they originate from a digital display rather than a genuine physical document. This capability helps maintain document integrity in an increasingly digital world.

-

Historical Acuity

Veryfi’s Fraud Intelligence utilizes Fraud History analysis for enhanced real-time detection. It maintains a dynamic database of past fraudulent activities, cross-referencing incoming documents against this data using machine learning. The system identifies similarities to known fraud cases in content, structure, or metadata. This approach flags potential repeat offenders and recognizes evolving tactics based on historical trends, providing adaptive protection against both recurring and novel fraud attempts.

-

and many more signals..

Contact sales@veryfi.com to learn how Veryfi can help you stop fraud in real-time.