The SALT (State and Local Tax) deduction is a federal tax benefit that allows taxpayers who itemize their deductions to reduce their federally taxable income by deducting certain state and local taxes they have paid. With the State and Local Tax (SALT) deduction cap potentially facing significant changes in 2025, organizations need robust systems to track and validate tax-related expenses. As proposals range from increasing the current $10,000 cap to $20,000 or even removing it entirely, tax professionals and accounting firms must prepare their expense management systems to properly identify, categorize, and report on eligible expenses.

The Challenge: Managing Complex Tax Deductions at Scale

Organizations face increasingly complex challenges when tracking and managing SALT deductions, particularly as regulatory changes loom:

Documentation and Data Capture Hurdles

- Paper-based inefficiencies: Physical receipts and invoices get lost, damaged, or become illegible, compromising deduction eligibility

- Manual data entry bottlenecks: Finance teams spend countless hours inputting receipt data, with error rates typically ranging from 4-8%

- Inconsistent categorization: Without standardized systems, different team members may categorize the same expenses differently, creating tax compliance risks

- Version control problems: Multiple copies of receipts and invoices create confusion about which document is authoritative

Compliance and Verification Complications

- Regulatory tracking complexity: Keeping pace with changing SALT caps and regulations across multiple jurisdictions often requires dedicated resources

- Audit trail gaps: Missing links between purchases, deliveries, and payments create vulnerabilities during tax audits

- Eligibility determination challenges: As deduction rules evolve, accurately determining which expenses qualify becomes increasingly difficult

- Proof of delivery limitations: Many organizations struggle to maintain proper documentation connecting purchases to verified deliveries

Financial and Strategic Impact

- Cash flow optimization barriers: Without timely visibility into deductible expenses, organizations miss opportunities to optimize tax strategies

- Forecasting difficulties: Limited data granularity prevents accurate projections of tax liability under changing SALT cap scenarios

- Resource misallocation: Teams often over-invest in low-value manual processes rather than strategic tax planning

- Missed deduction opportunities: Studies suggest businesses typically fail to claim 15-30% of eligible tax deductions due to documentation issues

These challenges become exponentially more difficult as organizations scale, regulations evolve, and deduction limits change. With the potential SALT cap adjustments on the horizon for 2025, businesses without robust systems risk significant tax inefficiencies, compliance issues, and missed financial opportunities.

What's Your Biggest SALT Challenge?

Tax pros: What challenges you most about SALT changes?

How Automated Receipt Processing Transforms Tax Management

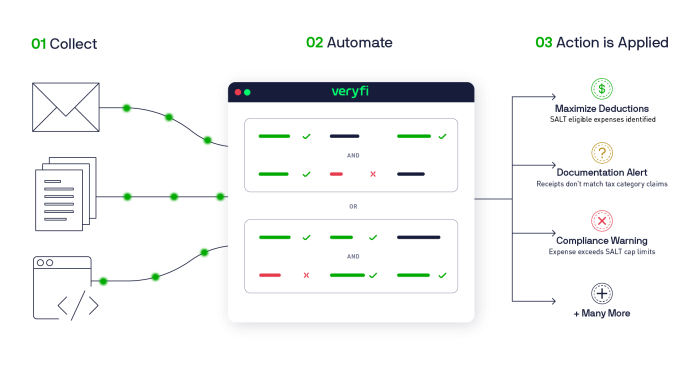

Modern AI-powered document processing solutions offer a path forward. Here’s how automated systems streamline SALT deduction tracking:

1. Advanced Data Extraction and Product Intelligence

Veryfi’s comprehensive solution combines powerful OCR APIs to extract and enrich purchase data:

- Detailed line-item extraction from receipts and invoices

- Transaction amounts and tax portions

- Merchant details and payment methods

- Time and date verification

This sophisticated extraction and enrichment process not only eliminates manual data entry but also provides granular visibility into purchases for precise tax deduction tracking. Try it yourself with the live extraction demo tool below!

2. Intelligent Product Categorization and Analytics

Veryfi’s Product Intelligence and Business Rules Engine work together to provide sophisticated categorization and analysis:

- Automatic expense categorization

- Cross-basket insights for tracking purchase patterns

- Smart flagging of transactions exceeding deduction thresholds

- Jurisdiction-specific tax rule application

- Advanced analytics for spend pattern analysis

- Standardized product categorization across vendors

- Strategic insights for vendor consolidation and cost optimization

This enhanced categorization ensures accurate tax classification while providing valuable insights for financial planning and compliance.

3. Two-Way Matching for Enhanced Accuracy

Two-way matching capabilities verify purchases against deliveries by:

- Comparing purchase orders against received goods

- Validating that claimed expenses match actual deliveries

- Identifying discrepancies between ordered and received items

- Ensuring tax deductions are based on verified transactions

- Creating audit trails linking purchases to deliveries

- Maintaining documentation required for SALT deduction claims

This verification process is crucial for tax compliance as it ensures that claimed deductions are supported by complete documentation of both the purchase and receipt of goods or services.

Best Practices to Prepare for SALT Changes

As organizations prepare for potential SALT deduction changes, here are key steps to optimize your tax documentation process:

- Audit Current Systems:

- Evaluate existing expense tracking methods

- Identify gaps in tax documentation

- Assess compliance with current regulations

- Implement Automated Solutions:

- Deploy OCR technology for receipt processing

- Set up tax-specific business rules

- Enable two-way matching capabilities

- Establish Monitoring Processes:

- Track deduction totals throughout the year

- Monitor regulatory changes

- Adjust rules and thresholds as needed

Business Impact

Organizations implementing Veryfi’s intelligent document processing and Product Intelligence for tax management typically see:

- 80% reduction in monthly processing time

- Enhanced accuracy in tax categorization through AI-powered product matching

- Streamlined vendor management and cost optimization

- Improved audit readiness with detailed product-level documentation

- Reduced risk of missing eligible deductions through granular line-item tracking

- Better strategic decision-making through cross-basket insights

- Optimized inventory and supply chain management with SKU-level analysis (32% cost reduction per Gartner)

Next Steps

To prepare your organization for upcoming SALT deduction changes:

- Explore Veryfi’s solutions for receipt and invoice processing by signing up for the free 14 trial account

- Schedule a demo to see how automation can streamline your tax management

With the right automation tools in place, organizations can adapt quickly to tax regulation changes while maintaining accurate records for maximum deduction eligibility.