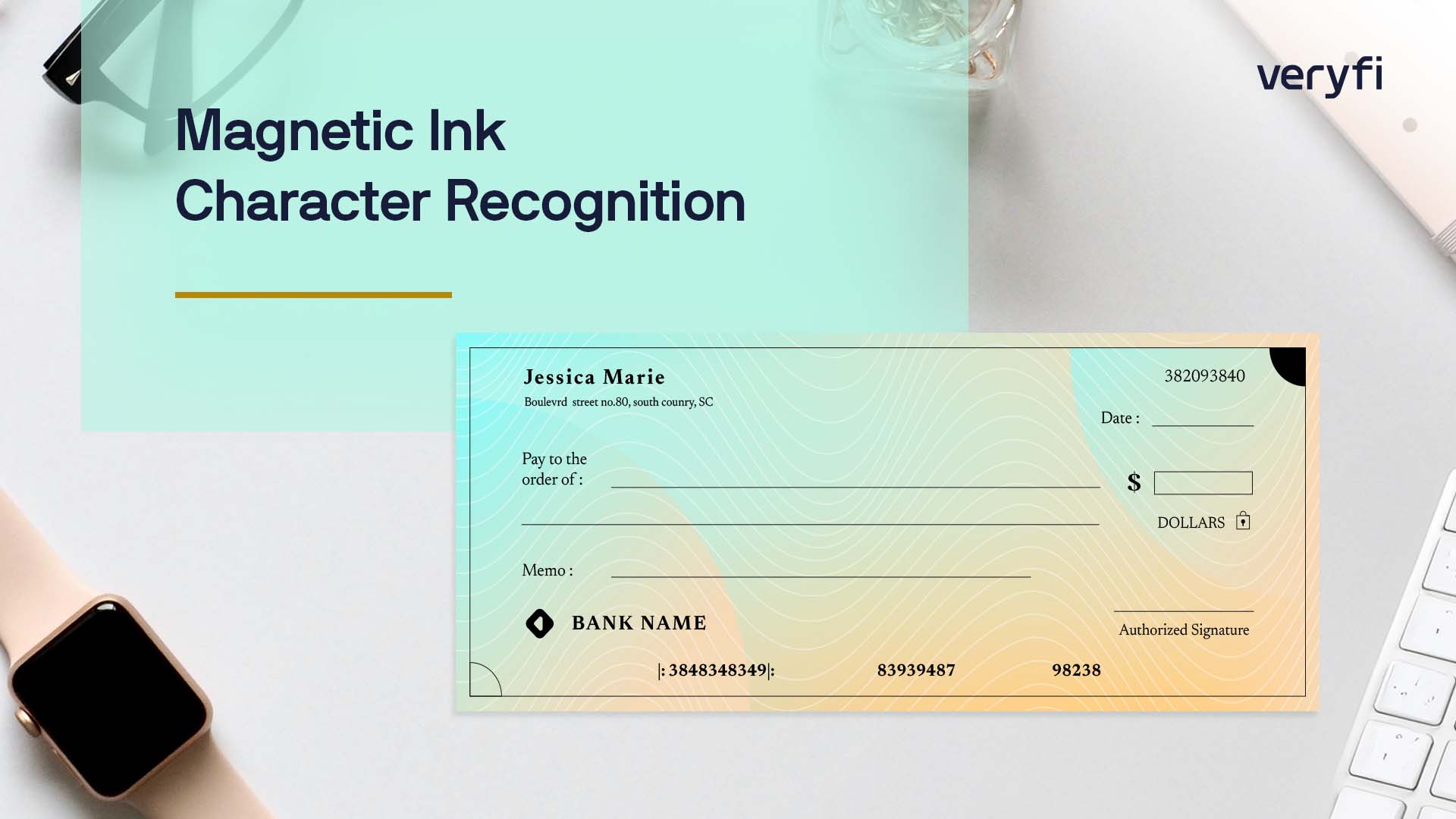

Harnessing structured data from bank checks, particularly the MICR (Magnetic Ink Character Recognition) fields, offers tremendous potential for understanding financial transactions and optimizing banking processes. With Veryfi’s advanced OCR APIs for check MICR fields at your disposal, extracting this valuable information becomes a matter of seconds. By simply uploading check images to the Veryfi portal, you gain immediate access to critical data points that empower you to take actionable steps. This streamlined process allows for swift decision-making and facilitates efficient management of check-related activities through automated bank check routing number extraction and account number identification.

What is Possible with MICR Line Data Extraction for Financial Institutions?

Here are a few possible applications for bank check MICR field data:

- Fraud Detection: Utilize the extracted MICR data to identify potential check fraud by comparing it against known patterns or suspicious activity.

- Automated Reconciliation: Leverage the MICR information for automated reconciliation of check transactions, improving accuracy and efficiency.

- Customer Behavior Analysis: Analyze check usage patterns and account information to gain insights into customer banking habits and preferences.

- Risk Assessment: Use the account and routing number data to evaluate the risk associated with certain transactions or accounts.

- Digital Check Processing Using MICR Data: Implement faster, more accurate check processing systems by leveraging the extracted MICR data.

Key Data Points from MICR Fields

As of writing, the following MICR fields can be obtained from Veryfi’s MICR line parsing algorithms for fintech applications:

- Routing Number

- Account Number

- Serial Number

- Raw MICR Text

Use Cases for MICR Fields: Enhancing Bank Check Verification Through MICR Analysis

Here’s a brief rundown of how you can use these MICR fields in your fintech solution to take advantage of the wealth of data Veryfi’s MICR code OCR technology for mobile banking provides:

| Field Name | Description | Insights & Intelligence | Possible Applications |

| Routing Number | A nine-digit code identifying the financial institution | Analyzing transaction patterns, understanding bank popularity | Bank identification, transaction routing, fraud detection |

| Account Number | Unique identifier for the account holder | Tracking individual account activity, customer profiling | Account verification, transaction matching, customer segmentation |

| Serial Number | Unique identifier for each check | Detecting duplicate checks, tracking check usage | Fraud prevention, check inventory management, transaction auditing |

| Raw MICR Text | Unprocessed MICR line data | N/A | Data validation, comprehensive check information analysis |

Over 150 fields can be extracted by Veryfi’s machine learning for check account number identification. See the whole list.

[Veryfi OCR API Worldwide Data Coverage]

Ready to Revolutionize Check Processing with Real-Time MICR Data Validation?

As the financial industry evolves, “Data is the new currency.” Embrace the future with Veryfi, positioning yourself for unparalleled success in the banking and fintech sectors. Tap into the immense power of MICR fields and check data, and embark on a remarkable journey of limitless possibilities. Let your imagination soar as you forge a path to innovation, with Veryfi’s API integration for MICR data extraction services by your side as your trusted companion. Prepare to transform check processing and make your mark in the world of financial technology by leveraging our deep learning models for complex MICR code interpretation. Sign up for a free trial today!