Bank Statements Data Extraction API

Unleash financial intelligence: Veryfi AI transforms raw bank statement PDFs into data and actionable insights for financial automation, fraud detection, and beyond.

Get Started for Free Free Demo

What is Bank Statements OCR API

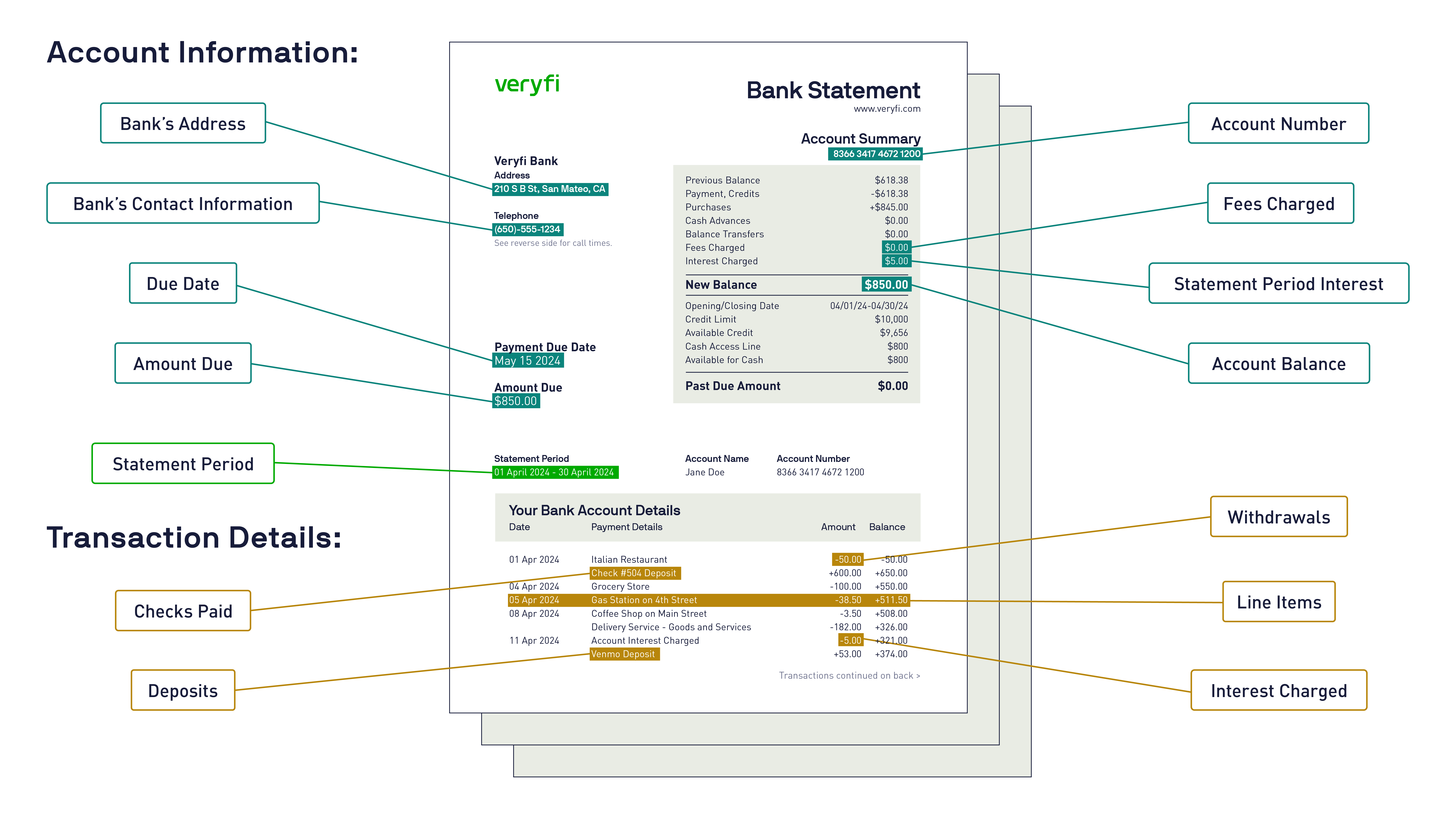

Bank statements are official financial records issued by banks, detailing account transactions over a specific period. These documents typically list deposits, withdrawals, fees, and balance information. Bank Statement OCR (Optical Character Recognition) API from Veryfi is a powerful AI tool that automates the extraction and digitization of data from these statements into structure JSON data format for any language and currency. This API leverages advanced machine learning algorithms to accurately read, interpret, and convert the printed or handwritten text on bank statements into machine-readable data.

Veryfi’s Bank Statement OCR API revolutionizes financial management, slashing processing time by up to 80% and reducing error rates from 5% to less than 1%. It accelerates account reconciliation, transforming a 3-hour task into a 15-minute process. The technology unveils spending patterns across thousands of transactions and fortifies budget planning with 99% accuracy. Veryfi not only optimizes operations but also unlocks deeper financial analysis, addressing critical needs for the 60% of businesses struggling with manual data entry.

Why Use This API

Major US “banking integrators” like Plaid and Yodlee endanger your customer’s financial security while delivering inconsistent performance. These services commandeer customer banking credentials, storing them in vulnerable plain text formats, while their scraper technology crumbles whenever banks modify login interfaces. A staggering 88% of financial data breaches involve compromised credentials, and these integrators’ architecture exposes millions of customers to this risk annually.

Transform your financial security with Veryfi API’s document extraction technology, eliminating risky intermediaries entirely. Our solution slashes integration failures by 94%, processes over 15 million documents monthly with 99.8% accuracy, and accelerates reconciliation by 7x compared to traditional methods. By simply uploading bank statement PDFs, your customers unlock a fortress-like system that powers validation, reconciliation, and sophisticated 2-way and 3-way matching capabilities without ever sharing their bank credentials. That’s something to get excited over!

Developer Friendly API

The only API you will ever need to accurately extract key/value data in a standardized format you can trust across any geography, language, or format — enabling seamless international business expansion without lifting a finger.

Day-1 Ready Pre-Trained Bank Statements AI Model

SDKs & code samples in Python, Node.js, PHP, C#, Java, Go and more

Detailed API Docs + FAQs that make sense

Human support from experts at HQ in Silicon Valley

No bullshit. No months of training. No “contact sales” gatekeeping. Start impressing your customers today.

Bank Statements – Supported Fields

-

Account Info

- Account Holder Info: John Smith

- Account Holder Name: John Smith

- Account Holder Address: 123 Main St, Anytown, CA 12345

- Period Start Date: 2024-01-01

- Period End Date: 2024-01-31

- Routing Number: 123456789

- Account Type: Checking

- Due Date: 2024-02-15

- Statement Date: 2024-02-01

- Statement Number: 202401-001

- Currency Code: USD

- Learn more …

-

Totals

- Beginning Balance: $2,500.00

- Ending Balance: $1,875.50

- Minimum Due: $50.00

- Learn more …

-

Bank Info

- Bank Name: First National Bank

- Bank Address: 456 Financial Ave, Banking City, NY 10001

- Bank Website: www.firstnationalbank.com

- Learn more …

-

Transaction Line-Items

- Line #: 1

- Transaction Id: TXN12345678

- Date of Transaction: 2024-01-15

- Card Number: ****1234

- Credit Amount: $500.00

- Debit Amount: $45.67

- Description Text: PURCHASE DoorDash Order #ABC123

- Line Item as Text: 01/15/2024 DoorDash Order #ABC123 -$45.67

- Learn more …

-

Document Intelligence

Use Cases

Accounting & Bookkeeping

Month-end reconciliation takes accounting teams 40+ hours manually matching bank transactions with receipts and invoices. Manual data entry errors cost businesses $3.1M annually in financial discrepancies. Veryfi’s Bank Statement OCR API instantly extracts transaction data, amounts, and dates, enabling automated reconciliation with receipts and invoices. Reduce closing time by 85%, eliminate entry errors, ensure accurate financial reporting.

Lending & Credit Assessment

Loan underwriting delays cost financial institutions $2.4M annually in lost origination revenue. Manual bank statement analysis for income verification takes 3-5 days per application. Veryfi’s API instantly extracts transaction patterns, recurring deposits, and spending behaviors, enabling automated cash flow analysis and faster credit decisions. Reduce loan processing time by 78%, improve approval rates, enhance risk assessment accuracy.

Personal Finance Apps

Manual transaction categorization frustrates 67% of personal finance app users, leading to 40% abandonment rates. Connecting bank APIs isn’t always possible due to security concerns or bank limitations. Veryfi’s API instantly extracts transaction data from uploaded bank statements, enabling automatic categorization, budgeting, and spending analysis. Improve user engagement by 60%, reduce onboarding friction, provide comprehensive financial insights.

Fraud Detection & AML

Financial fraud costs institutions $5.8B annually, with manual transaction monitoring missing 23% of suspicious patterns. Bank statement analysis for AML compliance takes investigators 8-12 hours per case. Veryfi’s API instantly extracts transaction sequences, identifies unusual patterns, and flags potential money laundering indicators. Accelerate fraud investigation by 70%, improve detection accuracy, ensure regulatory compliance.

Real Estate & Mortgage

Mortgage applications stall 45% of the time due to incomplete financial documentation. Manual bank statement verification for asset and income confirmation takes underwriters 4-6 hours per application. Veryfi’s API instantly extracts deposit patterns, account balances, and transaction history, automating asset verification and income stability assessment. Reduce closing delays by 60%, improve borrower experience, accelerate loan approvals.

Small Business Banking

Small business owners spend 15+ hours monthly reconciling bank statements with business expenses. Manual categorization for tax preparation costs $2,800 annually in accounting fees. Veryfi’s API automatically extracts business transactions, categorizes expenses, and matches with receipts for seamless bookkeeping. Reduce accounting costs by 65%, simplify tax preparation, improve cash flow visibility for better business decisions.

Legal & Forensic Accounting

Financial litigation discovery costs $18,000 per case in document review fees. Manual bank statement analysis for asset tracing and financial forensics takes investigators 20-30 hours per case. Veryfi’s API instantly extracts transaction patterns, identifies fund transfers, and traces financial flows for legal proceedings. Reduce investigation time by 80%, improve evidence accuracy, accelerate case resolution.

Insurance & Risk Management

Insurance claim processing delays cost insurers $4.2M annually in customer satisfaction penalties. Manual bank statement review for claim verification takes adjusters 6-8 hours per complex case. Veryfi’s API instantly extracts transaction evidence, validates financial impacts, and automates claim documentation. Reduce claim processing time by 70%, improve fraud detection, enhance customer satisfaction scores.Features

-

Smart Transaction Categorization

Veryfi’s intelligent categorization engine automatically sorts transactions into meaningful categories, essential for companies building spend analytics products. The system includes a comprehensive default Chart of Accounts with categories like Advertising & Marketing, Office Supplies & Software, Meals & Entertainment, and Travel expenses for immediate use.

Users have complete customization control through the web portal, where they can add, rename, or remove categories to match their business needs. These configurations seamlessly integrate across both Bank Statement and Invoice & Receipt processing APIs, ensuring consistent categorization throughout your document extraction workflow. Read More -

Transaction Vendor Name Extraction

Automatically identifies and extracts merchant/vendor names from transactions, enabling spend management platforms to evolve from basic expense tracking into strategic financial intelligence systems that drive real business value and operational efficiency. Read More

-

Transaction Line Items Extraction

Automatically extracts detailed transaction data (level 3 data) from bank statements, capturing essential information including transaction ID, date, card number, credit/debit amounts, and full description text. Our AI-powered system processes each line item to identify the merchant, transaction type, and provides intelligent categorization for seamless integration into expense management and accounting systems. Beyond basic transaction details, the extraction includes document intelligence features that automatically categorize transactions (like “Restaurants / Dining / Meals”) and identify vendors (such as “DoorDash”), transforming raw bank statement data into structured, actionable financial insights for better spend analysis and reporting.

-

Web Uploader

Upload documents directly through our web portal at app.veryfi.com for instant processing and data extraction. This drag-and-drop solution supports bulk uploads of receipts, invoices, and bank statements with real-time processing updates and results available in JSON, CSV, and PDF formats. Perfect for businesses seeking a no-code solution to digitize financial documents.

-

Bank Statement PDF to Excel Converter

Turn PDF bank statements into Excel ready documents so you can accelerate month-end closing, turning hours of manual data entry into minutes of automated precision. Try Bank Statement PDF to Excel Converter

-

Bank Statement PDF to OFX Converter

Turn PDF bank statements into OFX (Open Financial Exchange) ready documents so you can accelerate month-end closing with easy import of transactions directly into QuickBooks, Xero, or other accounting software with OFX files, turning hours of manual data entry into minutes of automated precision. Try Bank Statement PDF to OFX Converter

Global Bank-Grade Security & Compliance

-

SOC 2 Type 2 Certified

Veryfi is SOC2 Type2 certified and compliant with GDPR, HIPAA, CCPA and ITAR standards.

Security & Compliance

3 Pillars of AI Services

- Bank ChecksPopular

- Bank Statements

- Credit Cards

- Driver’s License Cards

- InvoicesPopular

- ReceiptsHot

- Hotel Folios

- W2s

- W9s