Two-way matching complexities are often overlooked as they’re expected to simply work. However, when accounting mistakes happen, businesses can lose lots of ROI. Without the accurate data extraction, mistakes happen all the time. The most exciting aspect of data extraction lies in its transformative potential. It’s not just about extracting information from documents. It’s about unlocking insights, driving efficiencies, and empowering better decision-making across an organization. Efficient accounts payable (AP) processes are crucial for any business aiming to maintain healthy cash flows and strong vendor relationships. One of the most effective methods to streamline AP processes is through two-way matching. For certain industries, simplifying three-way matching is key for revenue control, accuracy, and compliance. Both processes ensure that invoices are accurately matched with purchase orders, minimizing errors and preventing fraud. However, the true potential of two-way matching is unlocked when combined with Optical Character Recognition (OCR) technology. Find out how Veryfi helps corporations prevent accounting errors through automating two-way matching processes using fast, accurate, and secure AI-driven data extraction.

What is Two-Way Matching?

Also called purchase order matching, two-way matching is an accounting process that compares the purchase order (PO) and the vendor’s invoice before approving payment. The two key documents in this process are the purchase order and the invoice. The purchase order is a document issued by a buyer to a vendor, indicating the types, quantities, and agreed prices for products or services. The invoice is a document sent by the vendor to the buyer, requesting payment for goods or services provided.

The two-way matching process involves verifying that the details in the PO and the invoice match before payment approval. This ensures that the company is only paying for goods and services that were actually ordered and received, thus preventing overpayments and fraud. Two-way matching process is designated to check for discrepancies before approving and paying invoices. Think of it like a quality control, quality assurance measure.

Use Cases for OCR inside AP

Optical Character Recognition (OCR) converts different types of documents, such as scanned paper documents, PDFs, or images captured by a digital camera, into editable and searchable data. Integrating OCR with two-way matching can significantly enhance the efficiency and accuracy of AP processes. Using OCR with accounts payable means automating accounts payable processes. The following examples outline the deep benefits of merging the two.

1. Automated Data Extraction:

OCR technology can extract relevant data from invoices and purchase orders automatically. Fields such as invoice number, PO number, item descriptions, quantities, and prices are accurately captured without manual input. Having automated data extraction reduces the time and effort required for data entry, which thus minimizes human errors and increases productivity of human capital.

In the retail industry, for example, where businesses handle large volumes of purchase orders and invoices daily, OCR can transform operations. Retailers often work with numerous suppliers, each providing a variety of goods. Manually processing invoices and matching them with corresponding purchase orders can be labor-intensive and prone to errors. With OCR, retailers can automate this once error-prone process that relied on humans to read, ensuring that data from thousands of invoices is accurately extracted and matched to the corresponding purchase orders. This not only speeds up the process but also reduces the risk of human error, ensuring accurate payments and better supplier communications without the need for double-checking and triple-checking.

2. Enhanced Accuracy and Compliance:

By using OCR, businesses can ensure that the data extracted from invoices and purchase orders is accurate. This accuracy is crucial for the two-way matching process, as any discrepancies can be flagged for further investigation. Compliance with financial regulations is also improved, as OCR ensures that all documents are processed and stored correctly, making audits more straightforward and reliable.

In the healthcare industry, accuracy and compliance are paramount. Hospitals and clinics must process numerous invoices for medical supplies, equipment, and services while adhering to strict regulatory standards. OCR technology can help healthcare providers maintain accurate records, ensuring that payments are made only for goods and services that were actually ordered and received. By ensuring compliance with healthcare regulations, this prevents financial discrepancies, facilitates smoother audits, and reduces the risk of legal issues down the road. That is why Veryfi built ∀Docs with the highest level of security and compliance (SOC 2 Type 2), allowing users to extract data from any document.

3. Fraud Prevention:

OCR technology can detect anomalies and discrepancies between invoices and purchase orders that might indicate fraudulent activity. For instance, if the quantity or price on the invoice does not match the PO, the system can alert the AP team through flagging documents for having potential fraudulent fields. This proactive approach to fraud prevention helps safeguard the company’s finances and reputation.

In the field of finance, fraud prevention is a critical concern. Banks and financial institutions process a vast number of transactions daily, making them susceptible to fraudulent activities. OCR can play a vital role in identifying discrepancies between invoices and purchase orders, flagging potential fraud to prevent losses. By automating the data extraction and matching process, financial institutions can quickly identify and investigate suspicious activities, thereby protecting their assets and maintaining trust with their clients.

4. Cost Savings:

By automating the two-way matching process with OCR, businesses can reduce operational costs. The need for manual data entry and verification is minimized, allowing the AP team to focus on more strategic tasks. Additionally, faster processing times mean that early payment discounts offered by vendors can be captured more consistently, leading to significant cost savings.

Manufacturing companies, which often operate on tight margins, can greatly benefit from OCR technology. These companies deal with a high volume of invoices for raw materials, components, and services. Automating the AP process with OCR reduces the labor costs associated with manual data entry and matching. Moreover, by processing invoices quickly, manufacturers can take advantage of early payment discounts offered by suppliers, leading to substantial cost savings that directly impact the bottom line.

5. Improved AP and Vendor Relationships:

Timely and accurate payments are essential for maintaining good relationships with vendors. OCR technology ensures that invoices are processed quickly and correctly, reducing the likelihood of payment delays and disputes. Strong vendor relationships can lead to better terms and conditions, as well as improved service and support.

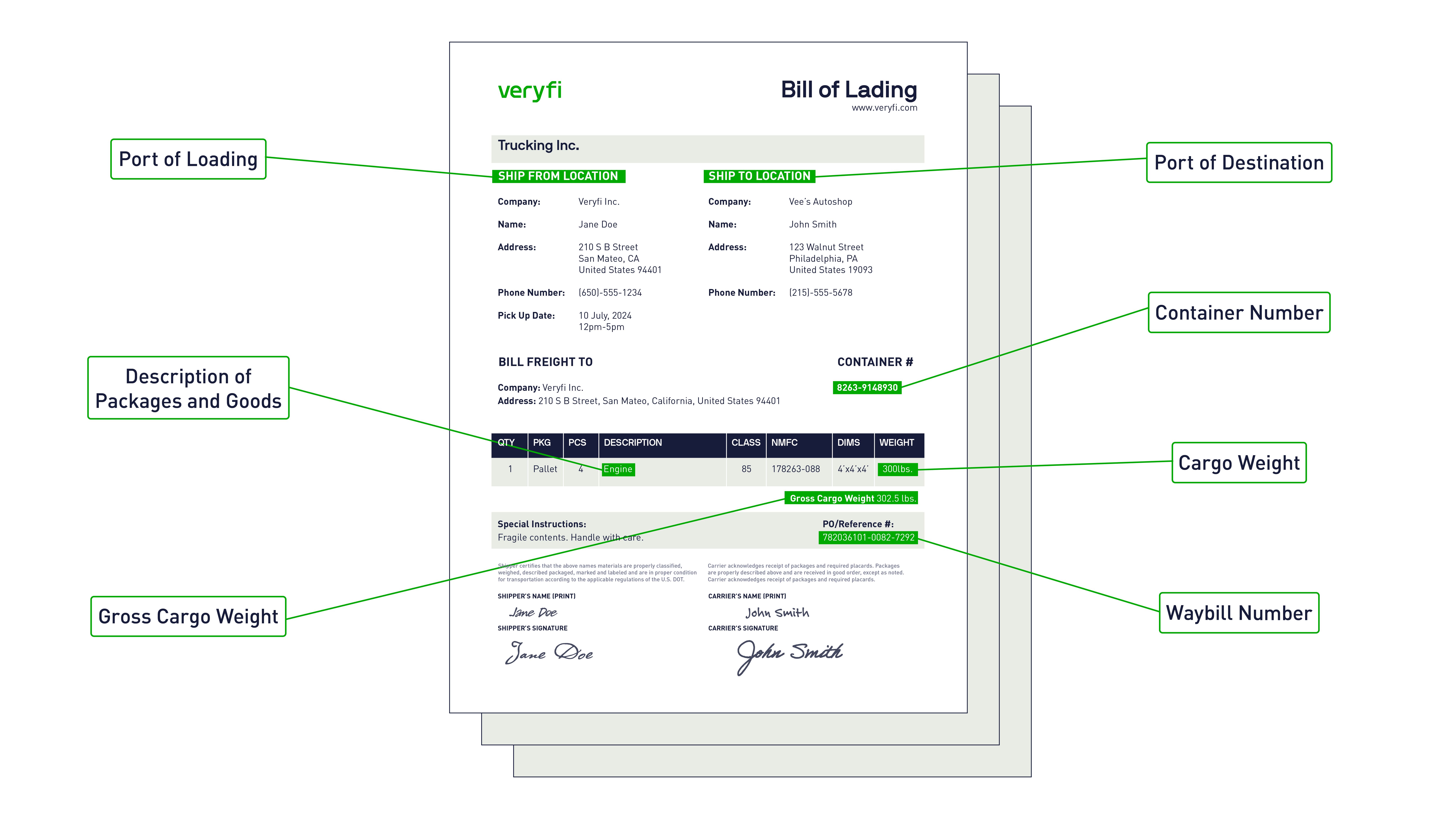

The logistics industry works with a wide variety of document types from bills of lading to goods received notes to delivery notes. Of course, then we have invoices and purchase orders on top of all those document types. Imagine everything from these individual documents can be extracted with near complete accuracy. That is a reality when logistics companies use Veryfi OCR inside operations and accounts payable processes. Also, maintaining strong relationships with vendors and suppliers is crucial for seamless operations. Logistics companies often rely on multiple vendors for transportation, warehousing, and distribution services. Delays in processing payments–because logistics companies are both the customers and the providers (span both ends of the business)–can strain these relationships, leading to service disruptions. By using OCR to automate AP processes that are once wrought with accuracy checks and other checks, logistics companies can ensure timely and accurate payments, fostering better relationships with their vendors and ensuring the smooth flow of goods and services.

Check out how easily Veryfi OCR parses every line item and data field from this bill of lading. Data extraction is done across 110+ data fields, 91+ currencies, and 38+ languages.

Implementing OCR into AP Processes

Implementing OCR technology in your AP processes involves several steps. Choosing the right OCR solution that integrates seamlessly with your existing AP systems is the first step. Look for features such as high accuracy, multi-language support, and the ability to handle various document formats. Next, configure the OCR to recognize the specific fields required for two-way matching. This includes mapping fields from purchase orders and invoices to ensure accurate data extraction.

Training your AP teams on using OCR effectively is also critical. Work with your customer success managers from Veryfi to ensure that the LLMs are accurately capturing and matching data from all document types. Finally, regularly monitor the performance of the OCR and make needed adjustments as they come up. With support for 110+ data fields, 91+ currencies, and 38+ languages, you can effortlessly extract line items from every critical document. This includes various languages, currencies, and their corresponding countries’ date and time formats. Continuous improvement will help maintain high accuracy and efficiency over time. Streamlining accounts payable processes with two-way matching is a powerful way to enhance financial control and efficiency. By integrating capable Veryfi OCR, businesses automate data extraction, improve accuracy, prevent fraud, and reduce costs. Embracing OCR not only simplifies the AP process but also strengthens vendor relationships and supports overall business growth.

Incorporate OCR into your accounts payable workflow today and experience the transformative benefits of automated two-way matching. The future of efficient and accurate AP processes is here, and OCR is leading the way.

For more information on how OCR can revolutionize your accounts payable processes, explore our solutions at Veryfi. Let’s transform the way you handle documents and data extraction together. Check out Veryfi YouTube for how-tos, demos, and more resources.